Nonprofits and Fidelity Charitable:

frequently asked questions

Does your nonprofit still receive checks? Enroll in EFT today.

Nonprofits play a critical role in our communities, and Fidelity Charitable donors are committed to supporting organizations doing work across a variety of cause areas. You may have some questions about our services or about donor-advised funds in general. Below are answers to common questions we hear from nonprofits.

A donor-advised fund, or DAF, is like a charitable investment account. A DAF program is sponsored by a public charity, called a “DAF sponsor” or “sponsoring organization.” A donor makes a charitable contribution to a DAF sponsor, becomes eligible to claim a tax deduction, and then recommends grants to IRS-qualified 501(c)(3) public charities. Donors can also recommend how their contribution is invested by the DAF sponsor, to potentially grow the contribution tax-free, which may ultimately provide more dollars to support nonprofits.

Fidelity Charitable is an independent, 501(c)(3) public charity. We sponsor the largest donor-advised fund program in the country. Our donor-advised fund is called the Giving Account. In 2024, our donors recommended more than $14.9 billion in grants to support more than 213,000 charitable organizations in every state and around the globe.

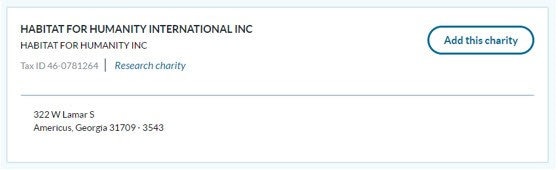

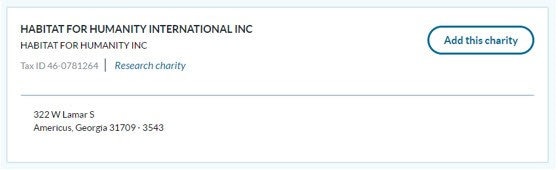

Fidelity Charitable generally makes grants only to IRS-qualified public charities, and all grant recommendations must comply with its Program Guidelines. Donors who are logged in to our website can search for nonprofits by name or tax ID number in our database (see image below). To make sure donors can find your organization, ensure that the name your organization is doing business as matches the name you have registered with the IRS and make it easy for donors to find your tax ID number on your website. Fidelity Charitable uses IRS data to display your organization’s name to donors logged in to our site. You can see exactly what this process looks like for a Fidelity Charitable donor by trying out our demo.

If you would like to make it easier for Fidelity Charitable donors to recommend grants to your nonprofit directly from your website, consider adding the DAF Direct widget to your website and enroll in Fidelity Charitable’s Electronic Funds Transfer (EFT) program. When you sign your nonprofit up for EFT from Fidelity Charitable, grants will be directly deposited into your nonprofit’s bank account—reducing the administrative burden of receiving paper checks

If your organization is a supporting organization, review the supporting organization guidelines here.

Fidelity Charitable grants are recommended by donors using a donor-advised fund (the Giving Account), typically an individual or corporate philanthropy team. A donor makes a contribution to Fidelity Charitable to establish a Giving Account. The donor can then recommend grants to IRS-qualified 501(c)(3) public charities. Fidelity Charitable does not accept applications for funding. Nonprofits should work directly with their donors who use donor-advised funds to discuss giving opportunities and needs. We recommend specifically naming donor-advised funds on your website as a way to support your organization, right alongside using a credit card or other form of online payment. Enroll in Electronic Funds Transfer (EFT) to receive grants an average of 9x faster. 1 in 5 organizations report having experienced mail fraud in the last year. EFT with Fidelity Charitable may help minimize risk with a safer, faster alternative to paper checks. Enroll here.

If you would like to make it easier for Fidelity Charitable donors to recommend grants to your nonprofit directly from your website, consider adding the DAF Direct widget to your website.

You can contact us with questions at 800-952-4438, option 4, Monday–Friday from 8:30 a.m.–6:30 p.m. ET.

We may reach out to you via phone or email while reviewing a donor’s grant recommendation to your nonprofit. If your best contact information currently does not match what is on file with the IRS, or if you would like to provide additional contact information, please contact us at 800-952-4438, option 4, Monday–Friday from 8:30 a.m.–6:30 p.m. ET

You can make updates to your organization’s address or contact information by contacting us at 800-952-4438, option 4, Monday–Friday from 8:30 a.m.–6:30 p.m. ET.

If you received a grant via Electronic Funds Transfer (EFT)

If you received the grant electronically via EFT, any donor-provided contact information was securely emailed to the email address(es) your organization provided during the EFT enrollment process in a document called a grant detail report. If you are having trouble accessing your grant detail report, please read our troubleshooting tips in the “Questions about the EFT grant detail report" section below. If you received an anonymous grant, the acknowledgment name and address columns in your grant detail report will all be blank. Only 4% of Fidelity Charitable grants are made anonymously.

Sample EFT grant detail report:

If you received a grant via paper check

If you received a paper check in the mail, any donor-provided contact information can be found on the grant transmittal letter that arrived in the envelope with the check.

Enrolling your nonprofit in Electronic Funds Transfer (EFT) is a safer, faster alternative to receiving paper checks. To enroll in the EFT program and have future grants directly deposited into your nonprofit’s bank account, you can start the enrollment process here.

Sample grant transmittal letters:

Only 4% of Fidelity Charitable grants are made anonymously. If a donor has chosen to make an anonymous grant, Fidelity Charitable cannot provide additional information about the donor. We encourage donors to provide contact information to the nonprofits they grant to by defaulting to providing a name and mailing address when a donor recommends a grant. You can see what this process looks like for a donor by trying out our demo.

You can receive grants electronically by enrolling your nonprofit into our free Electronic Funds Transfer (EFT) program. To enroll, submit your information through our secure EFT enrollment form. Enrollment requires you to provide either a voided check or bank letter dated within the last 12 months.

When you sign up your nonprofit for Fidelity Charitable’s Electronic Funds Transfer (EFT) program, grants will be directly deposited in your nonprofit’s bank account—no trips to the post office or bank needed. You’ll receive the same donor information as you would with a paper check. Electronic Funds Transfer is the fastest, safest, and most direct way to receive grants from Fidelity Charitable. Enrollment is easy.

Using any donor-provided information, thank the donor who recommended the grant to your organization, not Fidelity Charitable. The donor was eligible to claim their tax deduction upon making a contribution to Fidelity Charitable, not when recommending grants to charities like yours. Therefore, the donor is not eligible to claim a tax deduction in connection to their grant recommendations, and any language implying such should be removed from your acknowledgment and you should not send the donor a tax receipt.

Looking for more guidance on how to thank a DAF donor? This article includes tips and a customizable template you can download.

Fidelity Charitable will generally use the contact information on file with the IRS to reach you, information provided by the recommending donor, or information you have provided us over the phone directly to include in our records. The best way to help ensure that we can reach you with any questions would be to provide us a preferred contact email address and phone number by calling 800-952-4438, option 4, Monday–Friday from 8:30 a.m.–6:30 p.m. ET.

Fidelity Charitable grants are recommended by donors using a donor-advised fund (the Giving Account), typically an individual or corporate philanthropy team. A donor makes a contribution to Fidelity Charitable to establish a Giving Account. The donor can then recommend grants to IRS-qualified 501(c)(3) public charities. Fidelity Charitable does not accept applications for funding. Nonprofits should work directly with their donors who use donor-advised funds to discuss giving opportunities and needs. We recommend specifically naming donor-advised funds on your website as a way to support your organization, right alongside using a credit card or other form of online payment. If you would like to make it easier for Fidelity Charitable donors to recommend grants to your nonprofit directly from your website, consider adding the DAF Direct widget to your website.

Fidelity Charitable cannot reissue a grant check unless requested by the recommending donor. At the request of the receiving organization, we can void a grant check and notify the recommending donor; however, it will be up to the recommending donor to decide whether to reissue the grant. If your organization is looking to have a grant check reissued, we encourage you to contact the recommending donor directly. Fidelity Charitable cannot provide you with the donor’s contact information.

By enrolling in Electronic Funds Transfer (EFT), your organization can receive grant funds directly into your bank accounts up to 9x faster than through checks, eliminating delays and enabling quicker deployment of resources. Last year, 1 in 5 organizations reported mail fraud as a result of interference with the USPS. The secure use of EFT provides peace of mind, reducing risk of funds lost to fraud or theft.

Electronic Funds Transfer is the fastest, safest, and most direct way to receive grants from Fidelity Charitable. When you sign up your nonprofit for Fidelity Charitable’s Electronic Funds Transfer (EFT) program, grants will be directly deposited in your nonprofit’s bank account—no trips to the post office or bank needed. You’ll receive the same donor information as you would with a paper check. Enrollment is easy.

A grant detail report including all available donor information will be sent to you in a secure email every time you get a grant, or each day if you receive more than one grant in a day. You can choose up to five email addresses to receive grant detail reports. Those email addresses will receive the same donor information as would be mailed with a paper check.

Want to see what an EFT grant detail report looks like? See EFT grant detail report.

Having trouble accessing your grant detail reports? Check out our "Questions about the EFT grant detail report" section below.

You can begin the enrollment process by filling out this online form.

You can update the EFT banking information on file for your organization by completing this online form.

Customize an easy-to-use email template to start a conversation with nonprofits you support.

You can update your organization’s EFT contact information using this online form.

Yes, you can access your Fidelity secure email from a group or shared inbox, but you must have full access to the inbox. If you encounter a permission error, please open the webmail version of the inbox to access your secure email. If your organization does not have a webmail version of the inbox, you can also open the message in a private web browsing window.

Having trouble receiving the one-time passcode email?

It may have arrived in your spam, junk, or quarantine folder. Your technical team may be blocking or rejecting the one-time passcode email from Microsoft. The passcode email will come from the following email address: Microsoftoffice365@messaging.microsoft.com. You can whitelist or add this address to your safe sender list.

Getting a white screen or permission error when you try to open the Fidelity secure email?

Make sure you are accessing the original secure email. Forwarded email will not work. You can also open the message in a private web browsing window.

We’re here to help! If you have EFT or grant detail report questions that aren’t addressed here, feel free to reach out to us at 800-952-4438, option 4, Monday–Friday from 8:30 a.m.–6:30 p.m. ET.

General

A donor-advised fund, or DAF, is like a charitable investment account. A DAF program is sponsored by a public charity, called a “DAF sponsor” or “sponsoring organization.” A donor makes a charitable contribution to a DAF sponsor, becomes eligible to claim a tax deduction, and then recommends grants to IRS-qualified 501(c)(3) public charities. Donors can also recommend how their contribution is invested by the DAF sponsor, to potentially grow the contribution tax-free, which may ultimately provide more dollars to support nonprofits.

Fidelity Charitable is an independent, 501(c)(3) public charity. We sponsor the largest donor-advised fund program in the country. Our donor-advised fund is called the Giving Account. In 2024, our donors recommended more than $14.9 billion in grants to support more than 213,000 charitable organizations in every state and around the globe.

Fidelity Charitable generally makes grants only to IRS-qualified public charities, and all grant recommendations must comply with its Program Guidelines. Donors who are logged in to our website can search for nonprofits by name or tax ID number in our database (see image below). To make sure donors can find your organization, ensure that the name your organization is doing business as matches the name you have registered with the IRS and make it easy for donors to find your tax ID number on your website. Fidelity Charitable uses IRS data to display your organization’s name to donors logged in to our site. You can see exactly what this process looks like for a Fidelity Charitable donor by trying out our demo.

If you would like to make it easier for Fidelity Charitable donors to recommend grants to your nonprofit directly from your website, consider adding the DAF Direct widget to your website and enroll in Fidelity Charitable’s Electronic Funds Transfer (EFT) program. When you sign your nonprofit up for EFT from Fidelity Charitable, grants will be directly deposited into your nonprofit’s bank account—reducing the administrative burden of receiving paper checks

If your organization is a supporting organization, review the supporting organization guidelines here.

Fidelity Charitable grants are recommended by donors using a donor-advised fund (the Giving Account), typically an individual or corporate philanthropy team. A donor makes a contribution to Fidelity Charitable to establish a Giving Account. The donor can then recommend grants to IRS-qualified 501(c)(3) public charities. Fidelity Charitable does not accept applications for funding. Nonprofits should work directly with their donors who use donor-advised funds to discuss giving opportunities and needs. We recommend specifically naming donor-advised funds on your website as a way to support your organization, right alongside using a credit card or other form of online payment. Enroll in Electronic Funds Transfer (EFT) to receive grants an average of 9x faster. 1 in 5 organizations report having experienced mail fraud in the last year. EFT with Fidelity Charitable may help minimize risk with a safer, faster alternative to paper checks. Enroll here.

If you would like to make it easier for Fidelity Charitable donors to recommend grants to your nonprofit directly from your website, consider adding the DAF Direct widget to your website.

You can contact us with questions at 800-952-4438, option 4, Monday–Friday from 8:30 a.m.–6:30 p.m. ET.

We may reach out to you via phone or email while reviewing a donor’s grant recommendation to your nonprofit. If your best contact information currently does not match what is on file with the IRS, or if you would like to provide additional contact information, please contact us at 800-952-4438, option 4, Monday–Friday from 8:30 a.m.–6:30 p.m. ET

You can make updates to your organization’s address or contact information by contacting us at 800-952-4438, option 4, Monday–Friday from 8:30 a.m.–6:30 p.m. ET.

Receiving grants

If you received a grant via Electronic Funds Transfer (EFT)

If you received the grant electronically via EFT, any donor-provided contact information was securely emailed to the email address(es) your organization provided during the EFT enrollment process in a document called a grant detail report. If you are having trouble accessing your grant detail report, please read our troubleshooting tips in the “Questions about the EFT grant detail report" section below. If you received an anonymous grant, the acknowledgment name and address columns in your grant detail report will all be blank. Only 4% of Fidelity Charitable grants are made anonymously.

Sample EFT grant detail report:

If you received a grant via paper check

If you received a paper check in the mail, any donor-provided contact information can be found on the grant transmittal letter that arrived in the envelope with the check.

Enrolling your nonprofit in Electronic Funds Transfer (EFT) is a safer, faster alternative to receiving paper checks. To enroll in the EFT program and have future grants directly deposited into your nonprofit’s bank account, you can start the enrollment process here.

Sample grant transmittal letters:

Only 4% of Fidelity Charitable grants are made anonymously. If a donor has chosen to make an anonymous grant, Fidelity Charitable cannot provide additional information about the donor. We encourage donors to provide contact information to the nonprofits they grant to by defaulting to providing a name and mailing address when a donor recommends a grant. You can see what this process looks like for a donor by trying out our demo.

You can receive grants electronically by enrolling your nonprofit into our free Electronic Funds Transfer (EFT) program. To enroll, submit your information through our secure EFT enrollment form. Enrollment requires you to provide either a voided check or bank letter dated within the last 12 months.

When you sign up your nonprofit for Fidelity Charitable’s Electronic Funds Transfer (EFT) program, grants will be directly deposited in your nonprofit’s bank account—no trips to the post office or bank needed. You’ll receive the same donor information as you would with a paper check. Electronic Funds Transfer is the fastest, safest, and most direct way to receive grants from Fidelity Charitable. Enrollment is easy.

Using any donor-provided information, thank the donor who recommended the grant to your organization, not Fidelity Charitable. The donor was eligible to claim their tax deduction upon making a contribution to Fidelity Charitable, not when recommending grants to charities like yours. Therefore, the donor is not eligible to claim a tax deduction in connection to their grant recommendations, and any language implying such should be removed from your acknowledgment and you should not send the donor a tax receipt.

Looking for more guidance on how to thank a DAF donor? This article includes tips and a customizable template you can download.

Fidelity Charitable will generally use the contact information on file with the IRS to reach you, information provided by the recommending donor, or information you have provided us over the phone directly to include in our records. The best way to help ensure that we can reach you with any questions would be to provide us a preferred contact email address and phone number by calling 800-952-4438, option 4, Monday–Friday from 8:30 a.m.–6:30 p.m. ET.

Fidelity Charitable grants are recommended by donors using a donor-advised fund (the Giving Account), typically an individual or corporate philanthropy team. A donor makes a contribution to Fidelity Charitable to establish a Giving Account. The donor can then recommend grants to IRS-qualified 501(c)(3) public charities. Fidelity Charitable does not accept applications for funding. Nonprofits should work directly with their donors who use donor-advised funds to discuss giving opportunities and needs. We recommend specifically naming donor-advised funds on your website as a way to support your organization, right alongside using a credit card or other form of online payment. If you would like to make it easier for Fidelity Charitable donors to recommend grants to your nonprofit directly from your website, consider adding the DAF Direct widget to your website.

Fidelity Charitable cannot reissue a grant check unless requested by the recommending donor. At the request of the receiving organization, we can void a grant check and notify the recommending donor; however, it will be up to the recommending donor to decide whether to reissue the grant. If your organization is looking to have a grant check reissued, we encourage you to contact the recommending donor directly. Fidelity Charitable cannot provide you with the donor’s contact information.

Electronic Funds Transfer

By enrolling in Electronic Funds Transfer (EFT), your organization can receive grant funds directly into your bank accounts up to 9x faster than through checks, eliminating delays and enabling quicker deployment of resources. Last year, 1 in 5 organizations reported mail fraud as a result of interference with the USPS. The secure use of EFT provides peace of mind, reducing risk of funds lost to fraud or theft.

Electronic Funds Transfer is the fastest, safest, and most direct way to receive grants from Fidelity Charitable. When you sign up your nonprofit for Fidelity Charitable’s Electronic Funds Transfer (EFT) program, grants will be directly deposited in your nonprofit’s bank account—no trips to the post office or bank needed. You’ll receive the same donor information as you would with a paper check. Enrollment is easy.

A grant detail report including all available donor information will be sent to you in a secure email every time you get a grant, or each day if you receive more than one grant in a day. You can choose up to five email addresses to receive grant detail reports. Those email addresses will receive the same donor information as would be mailed with a paper check.

Want to see what an EFT grant detail report looks like? See EFT grant detail report.

Having trouble accessing your grant detail reports? Check out our "Questions about the EFT grant detail report" section below.

You can begin the enrollment process by filling out this online form.

You can update the EFT banking information on file for your organization by completing this online form.

Customize an easy-to-use email template to start a conversation with nonprofits you support.

EFT grant detail report

You can update your organization’s EFT contact information using this online form.

Yes, you can access your Fidelity secure email from a group or shared inbox, but you must have full access to the inbox. If you encounter a permission error, please open the webmail version of the inbox to access your secure email. If your organization does not have a webmail version of the inbox, you can also open the message in a private web browsing window.

Having trouble receiving the one-time passcode email?

It may have arrived in your spam, junk, or quarantine folder. Your technical team may be blocking or rejecting the one-time passcode email from Microsoft. The passcode email will come from the following email address: Microsoftoffice365@messaging.microsoft.com. You can whitelist or add this address to your safe sender list.

Getting a white screen or permission error when you try to open the Fidelity secure email?

Make sure you are accessing the original secure email. Forwarded email will not work. You can also open the message in a private web browsing window.

We’re here to help! If you have EFT or grant detail report questions that aren’t addressed here, feel free to reach out to us at 800-952-4438, option 4, Monday–Friday from 8:30 a.m.–6:30 p.m. ET.

Ready to get started?

Opening a Giving Account is fast and easy, and there is no minimum initial contribution.

Or call us at 800-262-6039