Study: 77% of Millennials have made an impact investment, but only 53% of advisors understand the concept well

Impact investing sees tremendous growth, but room exists for advisors to engage the next generation of investors and philanthropists

Fidelity Charitable Giving Account assets allocated to impact investments exceed $1 billion

BOSTON, MA, September 18, 2019 – Major gaps exist between financial advisors’ understanding of impact investing and their younger clients’ interest in the subject, according to a study released today by Fidelity Charitable, an independent public charity and the nation’s largest grantmaker.

While more than 70 percent of affluent Millennials and Gen-Xers report having made an impact investment, only 49 percent of advisors believe that the practice of investing with social or environmental purposes in mind is a long-term trend, and only 53 percent of advisors say that they understand the topic well. The 2019 study, “Impact Investing on the Rise: How Financial Advisors are Adapting,” examined the advisor perspective on impact investing and how advisors counsel clients on these strategies.

“While impact investing has grown tremendously over the last several years, this study indicates that there is still a strong opportunity for advisors to expand their knowledge of the sector,” said Sarah Gelfand, Vice President for Social Impact Programs, Fidelity Charitable. “Advisors who are savvy about the full breadth of strategies their clients might employ, including understanding the link between charitable giving and values-based investing, will be best prepared to help clients achieve their goals.”

Advisor awareness of impact investing varies

Just over half of advisors (53 percent) reported familiarity with impact investing, and awareness varies widely between those with higher and lower assets under management. Only 38 percent of advisors with less than $100 million under management report that they understand impact investing well compared to 62 percent of advisors with more than $100 million under management. This indicates an opportunity for all advisors to broaden their knowledge in order to initiate more impact investing conversations with clients, since these opportunities are increasingly accessible to investors of all asset levels.

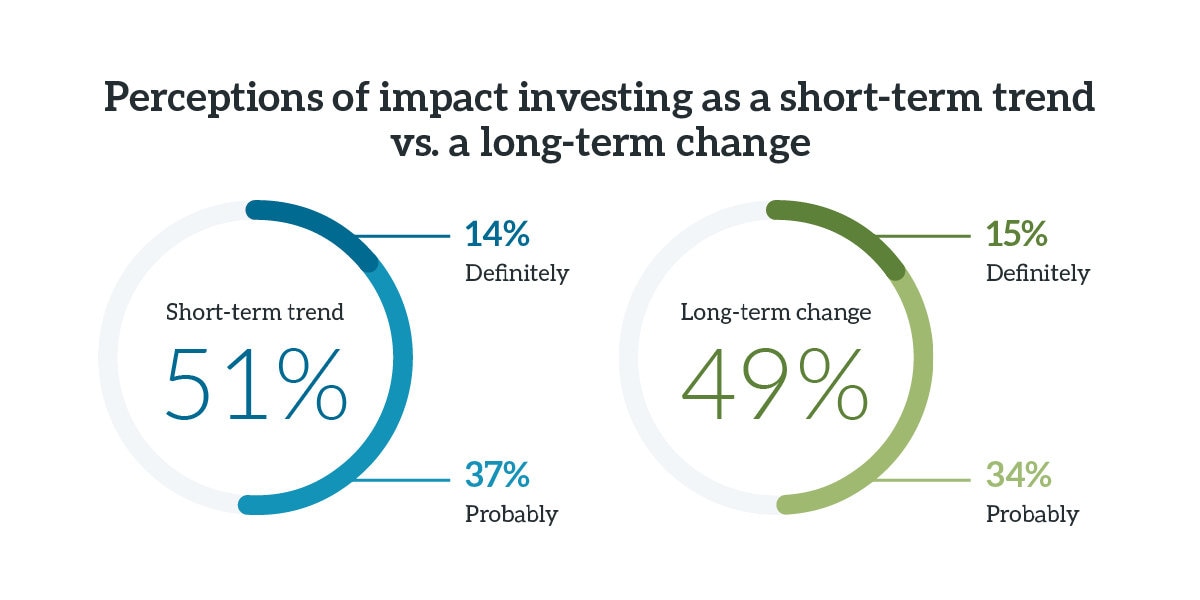

Short-term trend or long-term change? Advisors split

Only 49 percent of advisors believe that impact investing is a long-term change, while 51 percent say it is a passing trend. However, when it comes to personal preferences, nearly two-thirds (66 percent) of younger advisors (under 40 years old) say they are personally interested in impact investing, compared to just over half of advisors over 40 years old. This personal interest among next-generation advisors is mirrored with younger clients, as a large majority of affluent Millennials (77 percent) and Generation X (72 percent) indicated they had made some form of impact investment (compared to 30 percent of similar clients in the Baby Boomer and older generations). Next-generation advisor interest, along with client demand, is likely to drive a normalization of engagement in socially responsible investing.

Opportunity exists to broaden the discussion on impact investing

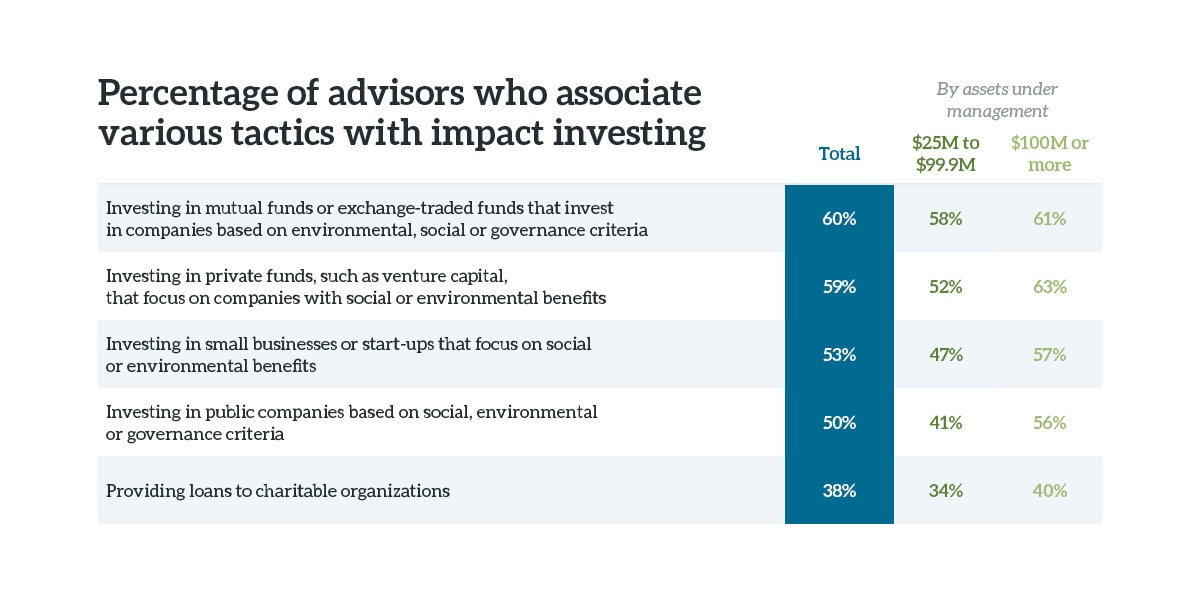

Advisors say they have discussed impact investing with fewer than half of their clients, even though 58 percent of consumers are interested in investing in companies with good social and environmental practices, and 44 percent said that help from a financial advisor would encourage them to make an impact investment. Additionally, advisors are most likely to define impact investing in its most basic forms, such as mutual funds that consider ESG (environmental, social, and governance) factors. They are far less likely to associate impact investing with approaches to financing nonprofits. As an example, only 38 percent of advisors think of making loans to charities as a way to engage in impact investing. Deeper knowledge of diverse strategies would allow advisors to better guide clients with an interest in impact investing.

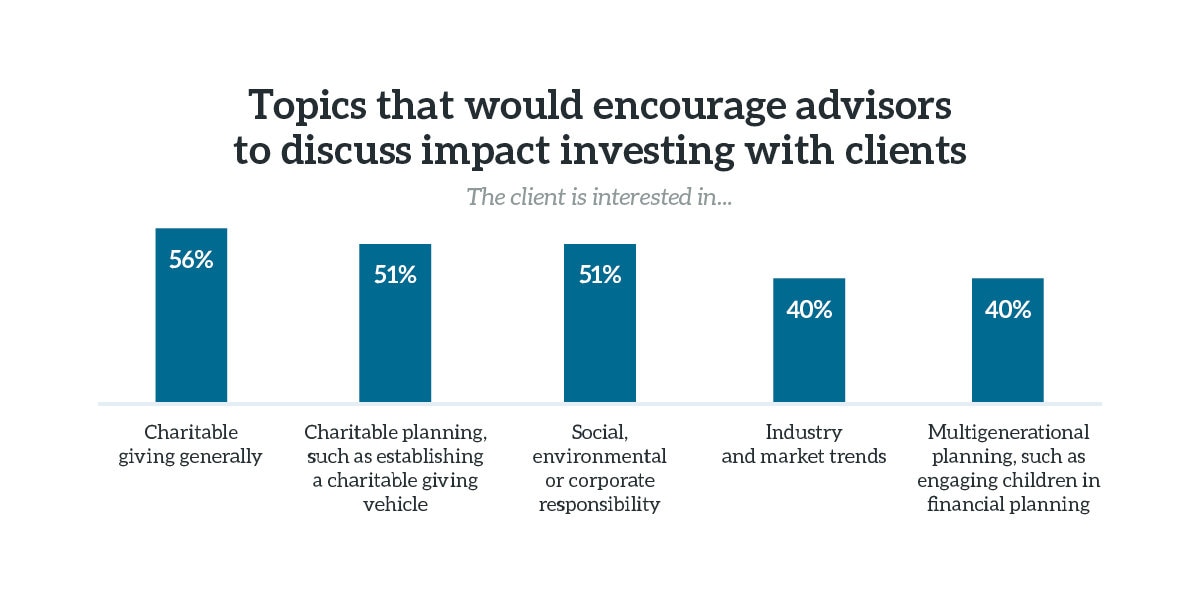

Starting the conversation

56 percent of advisors report that a client’s interest in charitable giving is a natural connection point to a discussion about impact investing. This approach is wise, as 79 percent of consumers who have made an impact investment rate charitable giving as “very important”—underscoring the link between philanthropy and impact investing.

Overall key findings

- Only 53 percent of advisors report that they understand impact investing well.

- Advisors have discussed impact investing with 41 percent of their clients, on average.

- 77 percent of affluent Millennials and 72 percent of affluent Gen-Xers report having made an impact investment.

- 51 percent of advisors believe that impact investing is a short-term trend, and 49 percent believe that it is a long-term change.

- 66 percent of next-generation advisors (under 40 years old) are personally interested in impact investing, compared to only 52 percent of advisors over 40 years old.

- 79 percent of consumers who have made an impact investment rate charitable giving as “very important.”

For additional detail on the study and reporting methodology, visit https://www.fidelitycharitable.org/insights/how-advisors-are-adapting-to-impact-investing-trend.html.

About Fidelity Charitable

Fidelity Charitable is an independent public charity that has helped donors support more than 278,000 nonprofit organizations with more than $35 billion in grants. Established in 1991, Fidelity Charitable launched the first national donor-advised fund program. The mission of the organization is to grow the American tradition of philanthropy by providing programs that make charitable giving accessible, simple and effective. For more information about Fidelity Charitable, visit https://www.fidelitycharitable.org.

Want to learn more?

Explore other news and resources, or reach out to us for a media inquiry.