Conversation tips for Advisors: Reaching the next generation

How can I involve my family in philanthropy?

Today, nearly 98% of people who inherit money move it from their family’s financial advisors within the first year.1 It’s imperative for you to look for ways to engage with this generation and keep your business sustainable. Incorporating charitable planning into your practice can help you reach your clients’ families and the next generation.

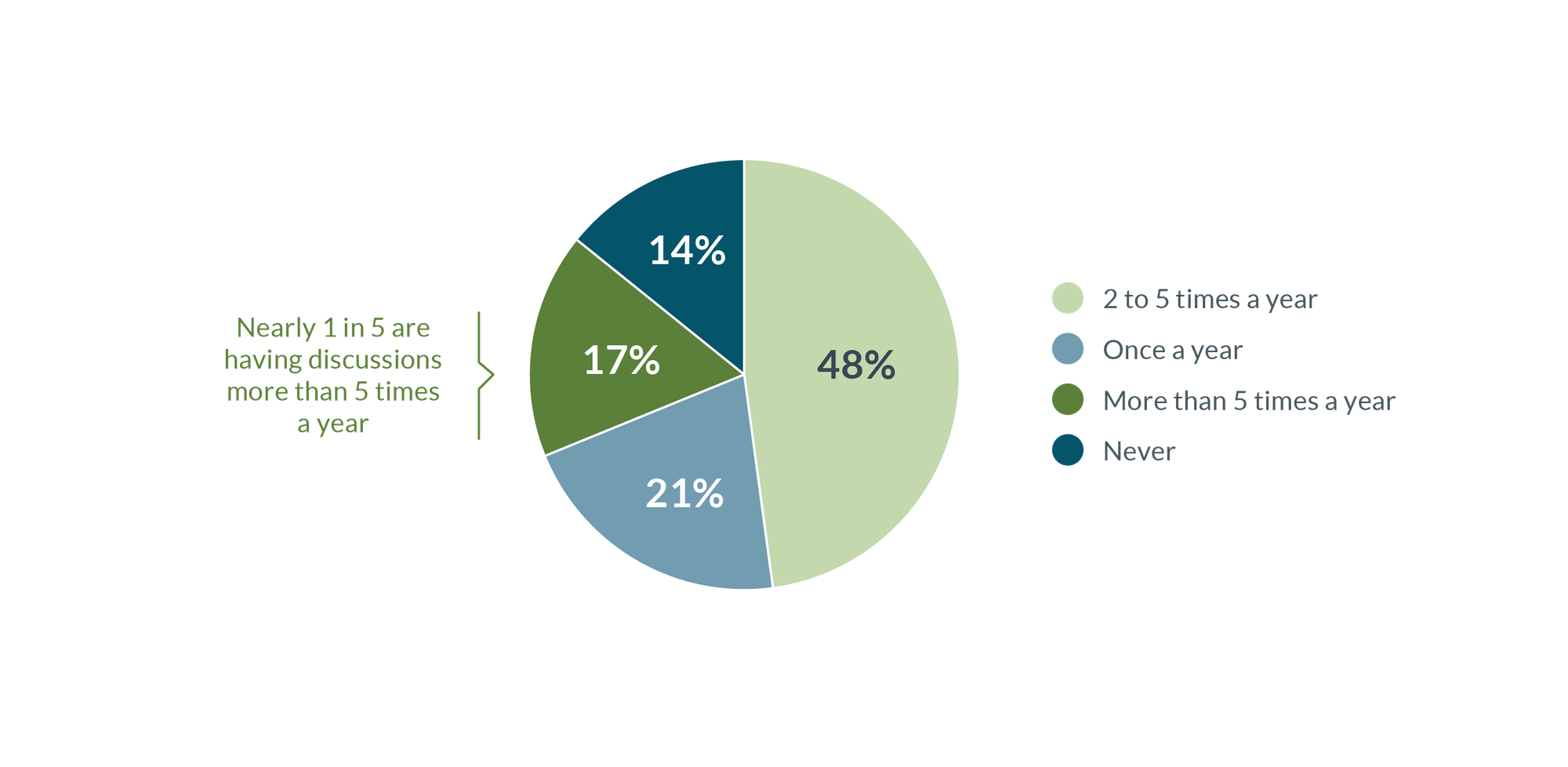

An overwhelming majority of Fidelity Charitable donors discuss charitable planning with their families at least once a year. And those who have made more than $1 million in charitable contributions are teaching their children to be generous—making this topic an easy way for you to connect with clients and their families.2

Conversation Tips

Tip #1

Point out the benefits your clients will enjoy by creating a family giving plan. It helps them:

- Cultivate family values

- Perpetuate their legacy

- Strengthen family relationships within and across generations and geographies

- Provide valuable learning and growth for the next generation

Tip #2

Zero in on client values.

- Are they currently involved with any charitable organizations?

- Do they currently contribute to any charitable organizations, including gifts (not tuition payments) to colleges/universities?

- Do they wish to include charitable giving in their plan?

- What legacy do they wish to leave?

Tip #3

Ask clients about their families.

- Does their family do any volunteer work together?

- Do they involve their family in philanthropic decisions?

- Have they named a successor to their donor-advised fund?

- How do they discuss wealth planning with their family?

Tip #4

Get introduced to the family.

- Include spouses and children in meetings to discuss philanthropic planning.

- Create a dedicated account for children to give from—like a donor-advised fund.

- Involve family in granting decisions.

Tip #5

Keep lines of communication open with the family.

- Identify preferred communication vehicles.

- Include family on relevant newsletters/communications.

- Invite your client and their family to attend a philanthropic event with you.

Tip #6

Discuss philanthropic activities with your clients that you engage in with your own family.

1Michael Sisk, How to Keep the Kids, Barron’s, June 2011.

2The U.S. Trust Study of the Philanthropic Conversation, October 2013.

Equip your clients for family philanthropy

Give your clients the tools they need to build a successful strategy for giving as a family.

How Fidelity Charitable can help

Since 1991, we have been a leader in charitable planning and giving solutions, helping donors like you support their favorite charities in smart ways.

Or call us at 800-262-6039