For Advisors

Frequently asked questions

Can I contribute cash via check or wire on behalf of my client?

Can my client donate restricted or controlled stock?

Can my client donate private or non-publicly traded assets?

Can my client donate cryptocurrencies?

Can my client donate master limited partnerships (MLPs)?

Can my client contribute from an IRA (QCD)?

What will my client receive after donating a complex asset?

How can I get tax receipts for filing purposes?

Why is additional information needed for third party contributions?

From a Fidelity Brokerage account, what is the most efficient way to make a contribution on behalf of my client?

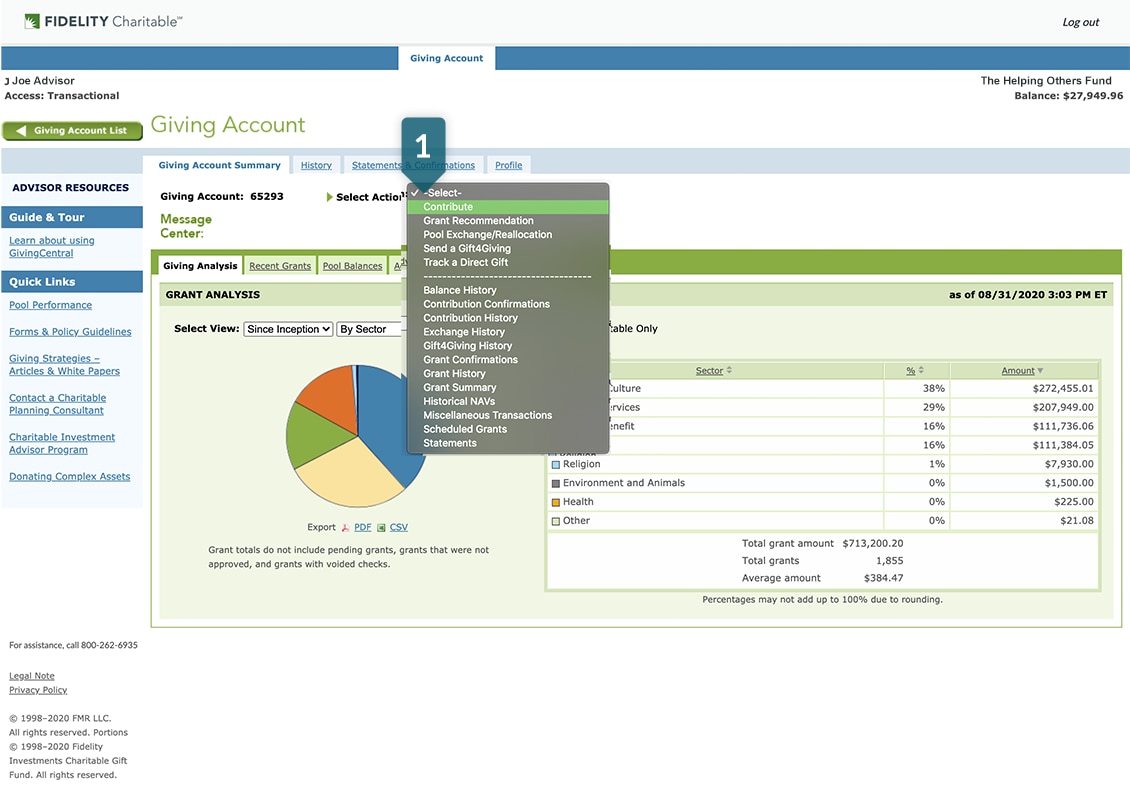

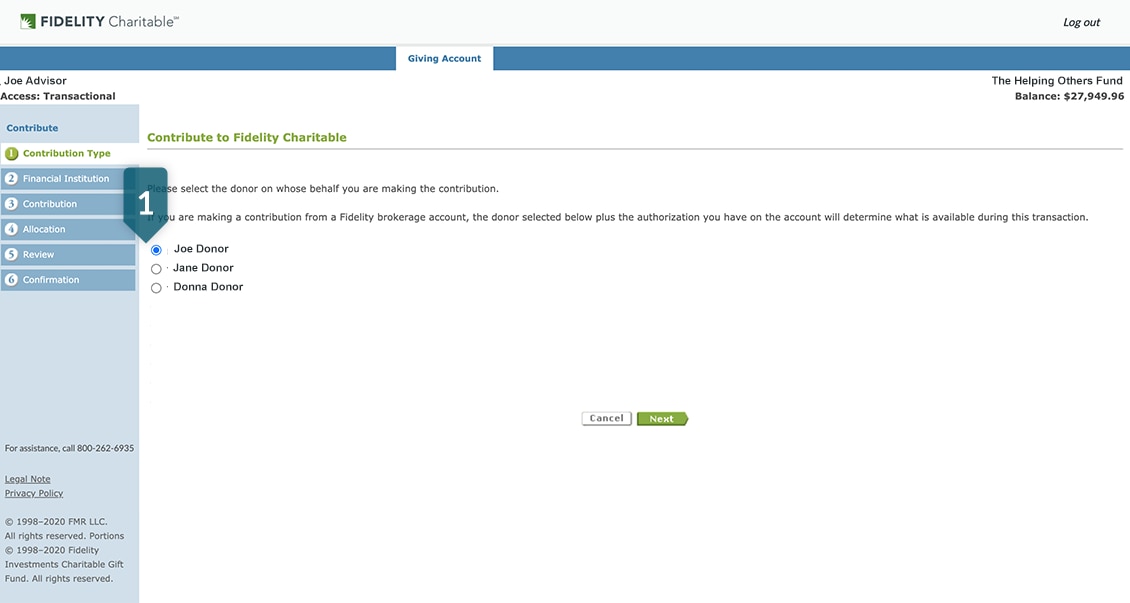

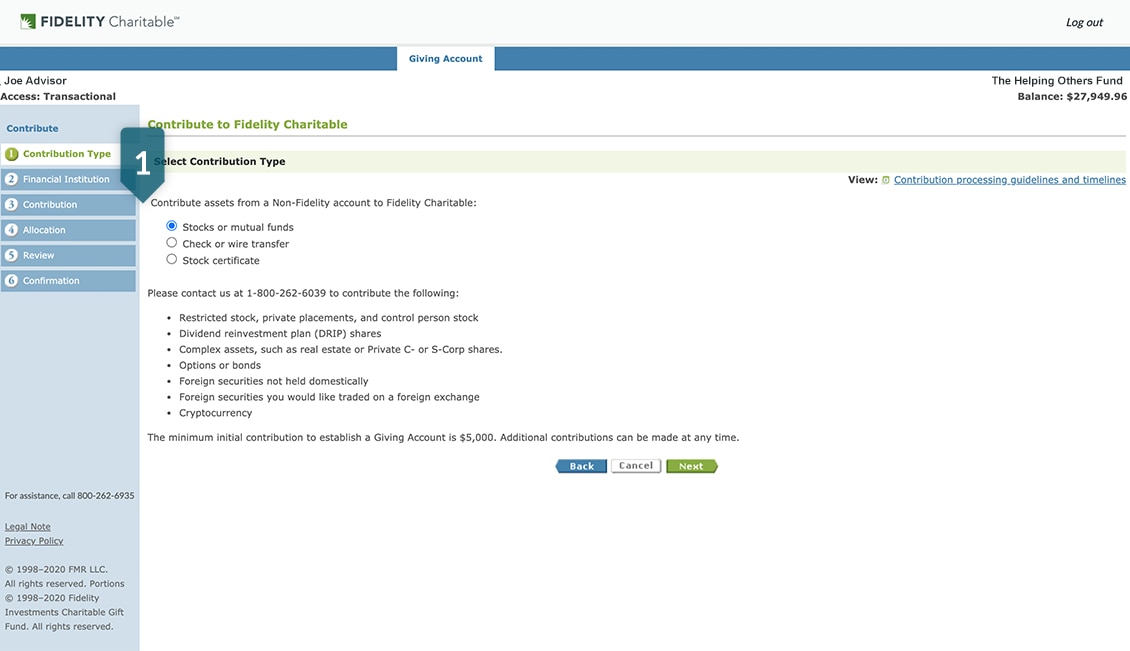

- Log in to GivingCentral and select your client’s Giving Account. Select Contribute from the drop down menu. You will agree to the disclosure agreement and then select the donor making the contribution. If you have authorization on a brokerage account*, you will see the Fidelity option. Continue in the flow to see position level information and tax lot information for appreciated securities.

*You do not have authorization on the Fidelity brokerage account if you can only see this option: Security Held at a Financial Institution

Any brokerage account registered to an entity like a trust will require you to provide additional information on the tax receipt recipient. This ensures Fidelity Charitable can provide an accurate tax receipt for the contribution and 8283 form (when applicable) for tax filing.

- Fidelity Charitable will initiate the transfer of securities.

- Fidelity Charitable will provide notification and a tax receipt to the donor when the contribution settles into the account based on e-delivery preferences. An alert will also be sent to you if you have subscribed to contribution alert. The tax receipt should also be available in GivingCentral for download.

This end-to-end process typically takes between 3-6 days.

Alternatively - you may use the Contribution Form for a non-digital experience. Once completed, use our “Document Upload” feature on GivingCentral to securely submit a scanned copy of the form for expedited processing. You will immediately receive a work item number for reference. If a fax is preferred, please send the form to 877-665-4274, or you can mail to: (Regular mail) Fidelity Charitable, P.O. Box 770001, Cincinnati, OH 45277-0053 / (Overnight mail) Fidelity Charitable, 100 Crosby Parkway KC1D-FCS, Covington, KY 41015-9325. Advisor signature is accepted for transactional advisors. For Wealthscape users, the G Number must also be included.

Note: Advisors with non-transactional or no access can make a contribution, but cannot specify pool allocation. Transactional access can be requested at any time from the GivingCentral dashboard.

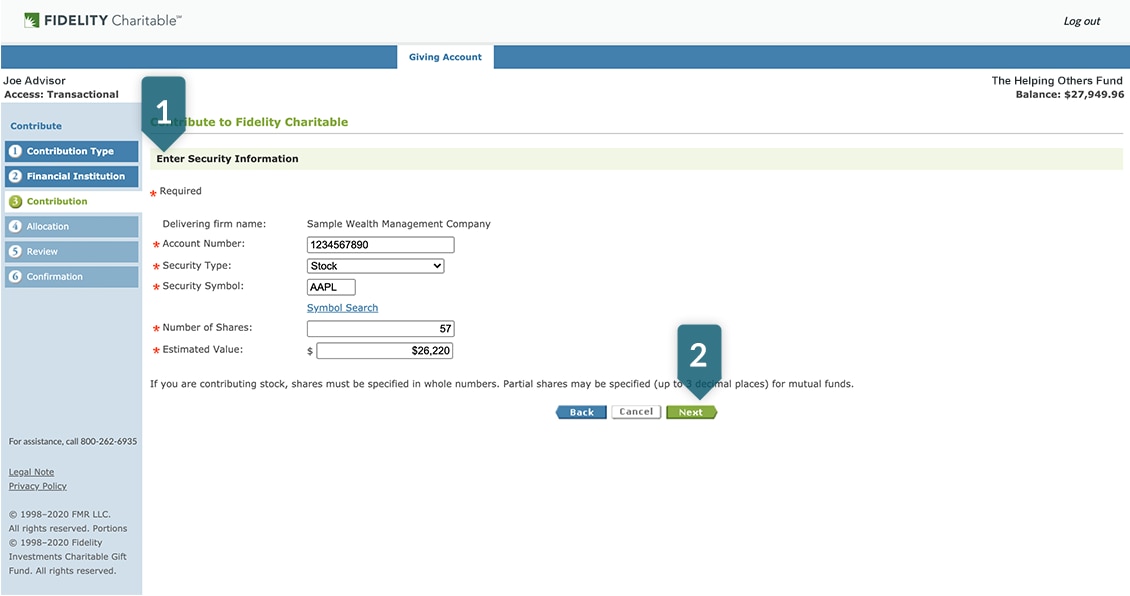

From a non-Fidelity Brokerage account, what is the most efficient way to make a contribution on behalf of my client?

To Initiate with Client

The fastest way to transfer the assets is to work directly with the outside firm, following the firm’s policies and procedures. These are the specific delivery instructions:

Deliver to DTC Clearing 0226

Account Number: Z97-000442

FBO: Fidelity Charitable Giving Account Number: _ _ _ _ _ _ _ _ _ _

See the Broker-Dealer Instructions

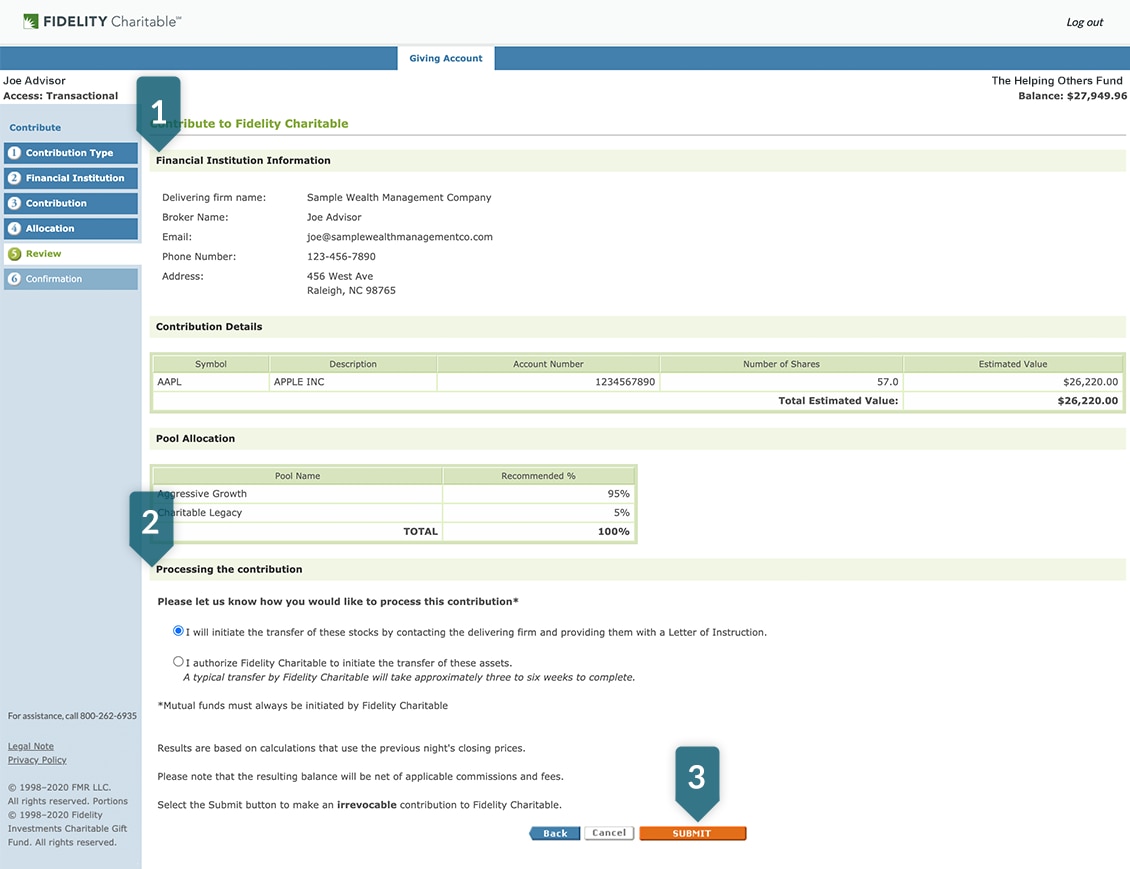

You must still notify Fidelity Charitable of the contribution either through GivingCentral (if you have transactional access to the Giving Account) or via the Contribution Form. This ensures that Fidelity Charitable is aware the contribution is coming and can process it appropriately.

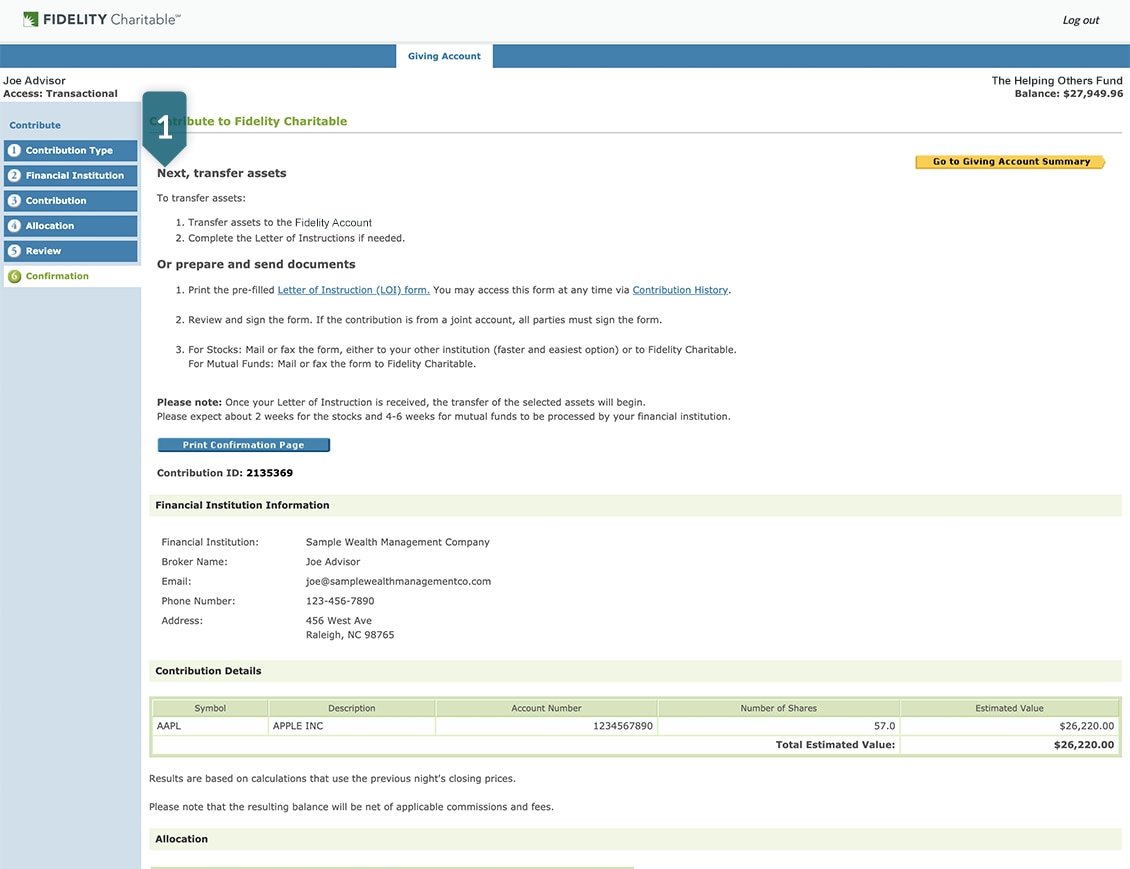

For Fidelity Charitable to Initiate

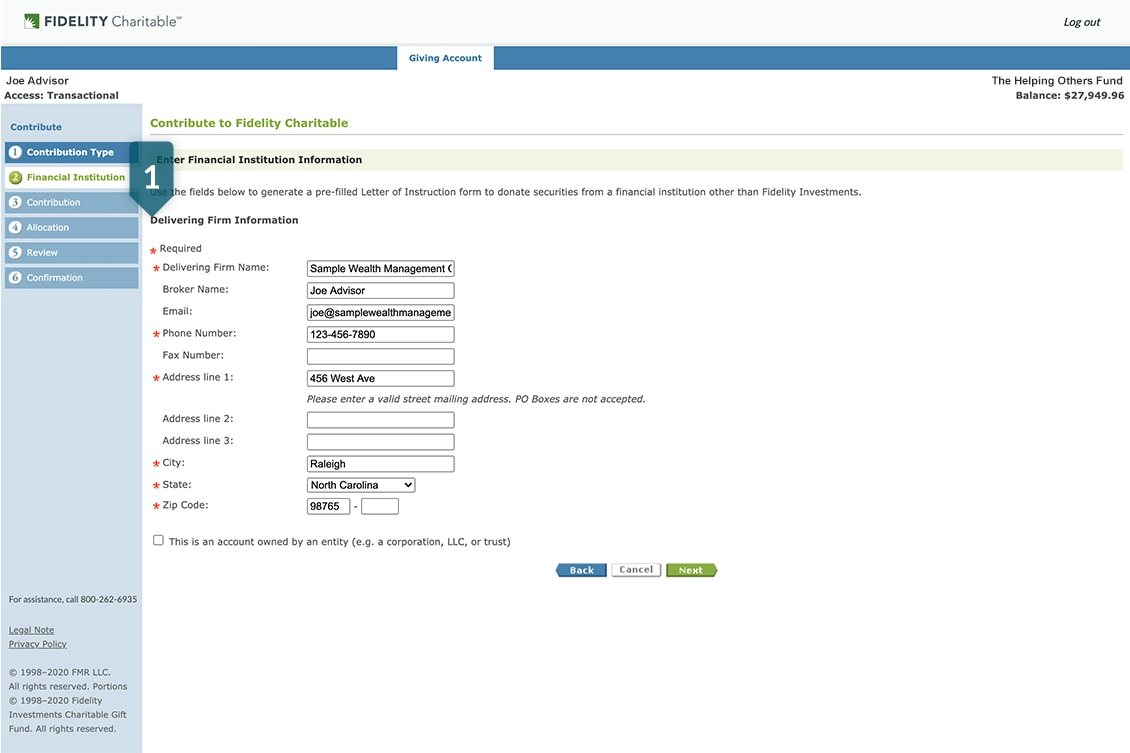

Alternatively, you may authorize Fidelity Charitable to initiate the transfer of assets by completing the following steps:

- Complete the paper Contribution Form or the LOI generated through GivingCentral

- Provide a copy the most recent statement from the account that the assets will be transferred from

Note: For mutual funds, Fidelity Charitable must initiate the transfer.

Additional Information

Once completed, please fax the form and statement copy to 877-665-4274, or you can mail to:

(Regular mail) Fidelity Charitable, P.O. Box 770001, Cincinnati, OH 45277-0053

(Overnight mail) Fidelity Charitable, 100 Crosby Parkway KC1D-FCS, Covington, KY 41015-9325

It typically takes 3- 6 weeks for Fidelity Charitable to receive assets from the outside firm. The information you provide will allow us to quickly match the contribution to the Giving Account once it is received. If we do not have the pending contribution on the Giving Account based on the information you provide, the assets could be returned to the outside firm.

Fidelity Charitable will provide notification and a tax receipt to the donor when the contribution settles into the account. An alert will also be sent to you if you have subscribed to contribution alert. The tax receipt should also be available in GivingCentral to download.

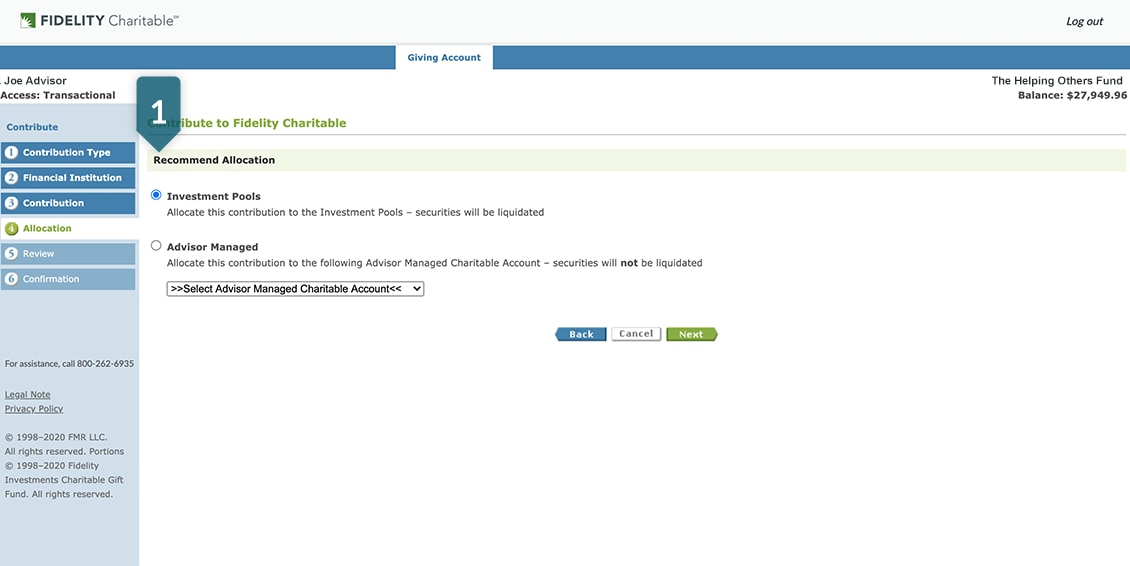

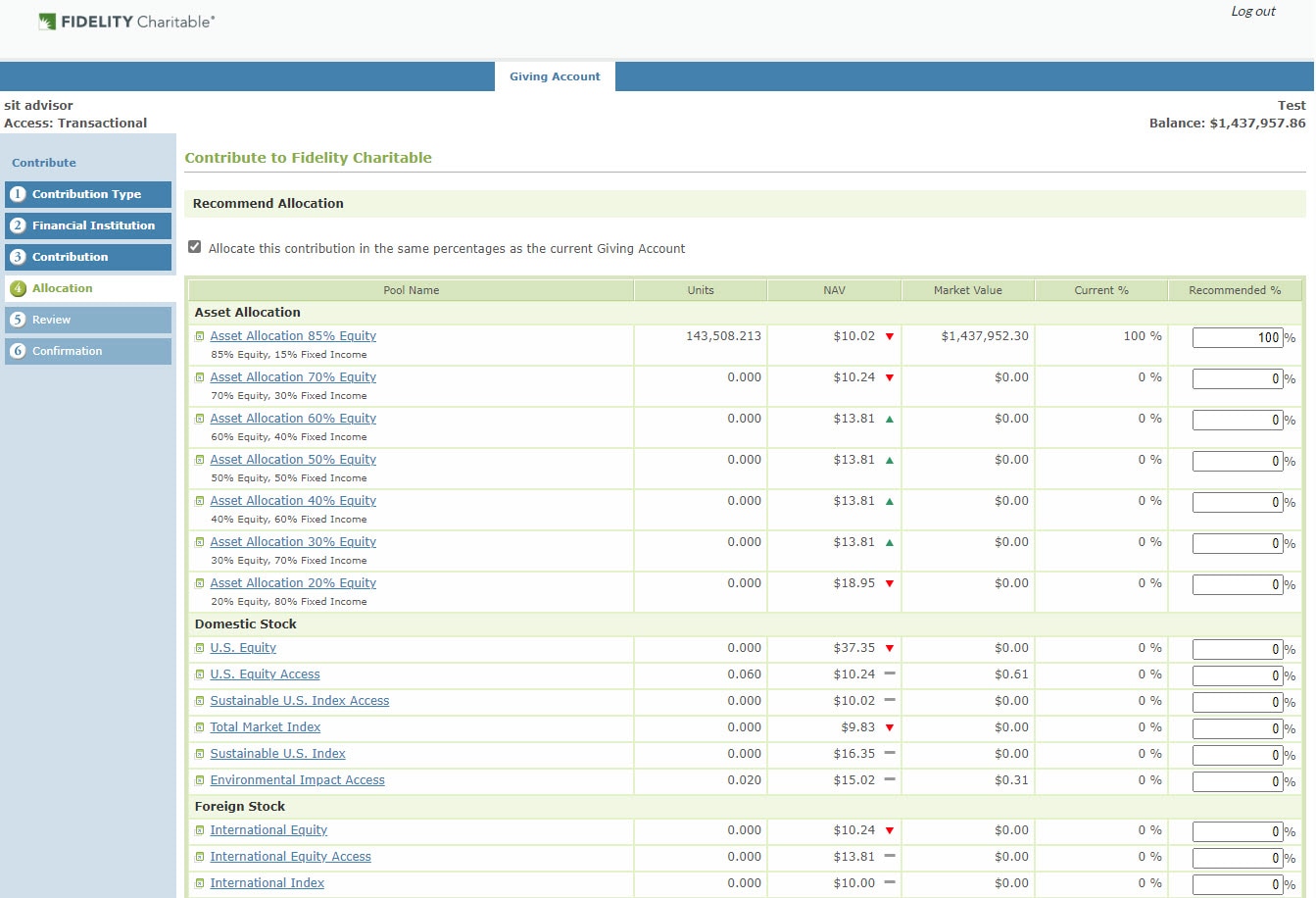

IMPORTANT NOTE: If a pool allocation is not selected, the contribution will be allocated to reflect the current pool allocation of the Giving Account. If the Giving Account is unfunded, the contribution will be allocated to the Asset Allocation 20% Equity Pool.

Can I contribute cash via check or wire on behalf of my client?

Yes, log in to GivingCentral (if you have transactional access to the Giving Account) and select Make a Contribution from drop down menu.

Select the option for check or wire transfer. You will be asked to provide information about the cash amount of the contribution and to recommend allocations. It is important to complete all steps and click Submit so that Fidelity Charitable is aware the contribution is coming and can process it appropriately.

For wire contributions

Fidelity Charitable will not initiate the wire. Specific instructions to wire include:

Wire to: JPMorgan Chase Bank

ABA: 021000021

For Credit to: NFS 066196-221

FBO: Fidelity Charitable Z97000442

Memo: CGF#_______

*The wire will be rejected if necessary account numbers are not provided, which may incur a fee from your bank.

For check contributions

- Make checks payable to Fidelity Charitable and reference the Giving Account number or name in the memo section

- Mail to: (Regular mail) Fidelity Charitable, P.O. Box 770001, Cincinnati, OH 45277-0053 OR (Overnight mail) Fidelity Charitable, 100 Crosby Parkway KC1D-FCS, Covington, KY 41015-9325

Fidelity Charitable will not accept contributions of currency or certain cash-like monetary instruments, including official checks, bank drafts, traveler’s checks, or money orders.

Fidelity Charitable will provide notification and a tax receipt to the donor when the contribution settles into the Giving Account. An alert will also be sent to you if you have subscribed to contribution alerts. A tax receipt should also available in GivingCentral to download.

IMPORTANT NOTE: If a pool allocation is not selected, the contribution will be allocated to reflect the current pool allocation of the Giving Account. If the Giving Account is unfunded, the contribution will be allocated to the Asset Allocation 20% Equity Pool.

- If the donor would like to contribute cash using Electronic Funds Transfer (EFT), they must log in to the donor portal to do so.

Alternatively, you may use the Contribution Form if you prefer a non-digital experience. Once completed, please fax the form to 877-665-4274, or you can mail to:

(Regular mail) Fidelity Charitable, P.O. Box 770001, Cincinnati, OH 45277-0053

(Overnight mail) Fidelity Charitable, 100 Crosby Parkway KC1D-FCS, Covington, KY 41015-9325. Advisor signature accepted for transactional advisors.

What can my client donate?

Cash equivalents, publicly traded stock, mutual fund shares, bonds, certain private or restricted stock, certain cryptocurrencies, and select real estate are eligible for contribution to Fidelity Charitable.

Can my client donate restricted or controlled stock?

To contribute restricted or controlled stock, Fidelity Charitable requires a 144/145 Contribution Form (PDF). Our Fidelity Charitable fundraising team is available to assist you in processing the contribution and if any additional special handling instructions are required.

Can my client donate private or non-publicly traded assets?

To contribute private or non-publicly traded assets, Fidelity Charitable requires a Complex Asset Contribution Form. They will also assist you in processing of the contribution and if any additional special handling instructions are required. More information can be found regarding Private company C-corp stock, Private company S-corp stock, LLC & Limited Partnership interests, Private equity and real estate.

Can my client donate cryptocurrencies?

To contribute certain cryptocurrencies, Fidelity Charitable requires a Cryptocurrency Letter of Understanding (LOU). Contact our Fidelity Charitable fundraising team to process the contribution as additional special handling instructions may be required.

Can my client donate master limited partnerships (MLPs)?

Please contact the Fidelity Charitable fundraising team for more information.

Can my client contribute from an IRA (QCD)?

It is important to speak with a tax advisor or attorney about your client’s specific situation. Fidelity Charitable does not provide tax or legal advice. In general, whenever you take money out of a tax-deferred account (IRA, 401(k), 403(b), etc.), the distribution is considered income to your clients and is a taxable event. Therefore, they would have to pay the taxes due upon the value of the distributed assets and the remaining money would go to the charitable organization.

Some charities (such as private foundations and donor-advised funds) do not qualify for QCDs. However, there may be certain exceptions for "employer securities" (shares of an employer's stock, or "company stock") held in a 401(k) account. Please consult a tax advisor for more information.

What will my client receive after donating a complex asset?

Your client will receive a confirmation letter that serves as a record of the contribution for tax deduction purposes. The letter also states that the tax-deductible value of a charitable contribution is generally the Fair Market Value on the date of the contribution. This confirmation reports the Fair Market Value for cash contributions as the amount of cash received. For publicly-traded securities, the Fair Market Value is reported as the average of the high and low prices on the date Fidelity Charitable received the contribution (i.e., the "Receive Date"). For all other assets, the Fair Market Value is reported as "N/A". Generally, unless an exception is available, you need an appraisal for contributions of non-publicly traded assets for which you claim a deduction of more than $5,000.

- An 8282 will be generated after the complex asset is liquidated and is then filed by Fidelity Charitable with the IRS. No action is needed by your client.

- Additional receipts for complex assets will be available upon request.

How can I get tax receipts for filing purposes?

You can access your clients’ tax receipts on GivingCentral. Select the client’s account, click on the Statements & Confirmations tab and then Form 8283 and select which year is need. If you need other tax receipts, click on Contribution, Exchange, and Miscellaneous Transaction Confirmations (on the Statements & Confirmations tab). Then use the drop down to select which date is need.

Donors can access their tax receipts online. After logging into the donor portal, click the "History" tab and then "Statements & Confirmations". Then use the dropdown menu to select IRS Form 8283. All available forms will be displayed on the page. If you need other tax receipts, use the dropdown menu and select "Contributions (tax receipts) & misc.

- Note that the 8283 Form is only for contributions of securities over $500.

- There is a tax receipt on each contribution which can easily be pulled by anyone with access under Giving Account Summary, Recent Contributions.

- For Complex Assets contributions, an 8283 will not be generated.

- Donors can also obtain blank 8283 forms from the IRS website at www.IRS.gov. Click on the “Forms & Instructions” tab and type “8283” in the Forms, Instructions and Publications Search box to select the desired form.

- Review our comprehensive list of FAQs around IRS Form 8283.

Why is additional information needed for third party contributions?

A third party is any person or entity that makes a contribution to Fidelity Charitable that is not an Account Holder on the Giving Account. Third parties can include a trust (even if the TIN matches the donor’s SSN), corporation, limited liability company, or partnership.

Fidelity Charitable is responsible for providing the most accurate documentation based on available information to its donors for their contributions for tax reporting. Some donors choose to make contributions to Fidelity Charitable on behalf of third party entities, and we understand that it is critical for the documentation for tax reporting to be accurate to ensure donors and donor-advisors can file their tax returns accurately.