Quarterly Investment Review

A message from the Investment Management Team of Strategic Advisers LLC

By Brian Enyeart, CFA®,* President, Strategic Advisers LLC

Third Quarter 2024: Key Takeaways

MARKET BACKDROP

Global stocks and bonds rose as economies grew around the world.

POSITIONING

Shifted stock allocations to take advantage of opportunities in international stocks, real estate investments, and Treasury inflation-protected securities (TIPS).

PERFORMANCE

Utilities and real estate led the rally in stocks, while bonds surged and entered positive territory for the year.

OUTLOOK

Economic expansion likely to continue as the U.S. Federal Reserve (Fed) cuts rates.

Market Backdrop

Global economic growth supported stocks.

- U.S. stocks climbed higher amidst economic strength.1

- International stocks outperformed U.S. stocks for the quarter.2

The U.S. job market remained strong with low unemployment. Although hiring slowed for the quarter, it remained positive, and wages continued to rise. Consumer spending showed strength, albeit with fewer purchases of big-ticket items, like appliances. Against this backdrop, service industries (retail, financial services, etc.) remained healthy. Manufacturing activity, on the other hand, shifted downward.

The Fed stepped in to support job growth and the economy by cutting rates for the first time in four years. So far, the Fed’s efforts have proven successful. Inflation dropped below 3.0% as levels returned to long-term averages.3 Fears of recession failed to materialize. Additional Fed rate cuts may support further economic growth and lower borrowing costs for consumers and businesses.

U.S. Stocks

Within U.S. stocks, in a reversal of recent trends, value stocks significantly outperformed growth stocks for the quarter.4 Likewise, smaller company stocks outperformed large stocks.5 For the first half of the year, large growth stocks had mostly been supported by a handful of high-performing technology stocks. However, these investments lost some of their luster over the quarter as investors debated the earning potential of artificial intelligence related technologies.

International Stocks

The drop in the U.S. dollar6 and solid earnings growth helped international developed market stocks have a strong quarter. In a change from last quarter, Japan lagged other international developed market countries when their economy showed some mixed results. Germany, France, and the U.K. were among the bigger leaders for Europe.

Emerging market stocks had a particularly strong quarter, outpacing both U.S. and international developed stocks. China and India led emerging market countries for the quarter. China unleashed several policy measures to support its economy which led to an exceptional stock market rally.7 Meanwhile, India’s earnings growth trends led to strong stock returns.8

Bonds

Fed policy seemed to shift during the quarter from fighting inflation to supporting the U.S. job market. Signals have indicated the market expects the Fed to cut rates again in November and December, this year. Potential for additional cuts could influence bond market performance.

Investment-grade bonds produced positive results for the quarter.9 Corporate bonds and mortgage-backed securities (MBS) had notable returns, supported by falling interest rates. Treasuries were positive but lagged the rest of the investment grade bond market.10 High-yield bonds also had an excellent quarter, modestly outperforming investment-grade bonds.11 Short-term bonds were positive but lagged other bond investments.12

Positioning

Reallocated some investments as we sought to manage risk during prolonged expansion.

- We have continued our on-going risk management strategy with small reductions to overall stock exposure.

- We shifted allocations away from U.S. stocks and commodities toward international stocks, real estate, and treasury inflation-protected securities (TIPS).

Market volatility has been common during prior periods of prolonged expansions. As a result, we have kept the overall portfolio close to neutral to help manage risk.

U.S. Stocks

We have maintained our trend of keeping exposure within U.S. stocks close to the benchmark13 with a greater emphasis on research-driven managers, value stocks14, and quality investments.15

International Stocks

We added some exposure to international developed markets and trimmed exposure to emerging markets. Overseas, earnings outlooks and valuations have remained attractive. As a result, we have kept exposures to international stocks higher than long-term targets. We have added exposure to quality stocks and maintained exposure to low-volatility investments.

- Within international developed market stocks, we limited exposure to smaller companies due to higher potential for market volatility.

- Within emerging market stocks, we reduced exposure to China below the benchmark16 to help manage risk.

Bonds

We left exposure to investment-grade and short-term bonds unchanged. These investments may provide stability during periods of market volatility. We also maintained allocations within high-yield bonds, international bonds, and bank loans.

Performance

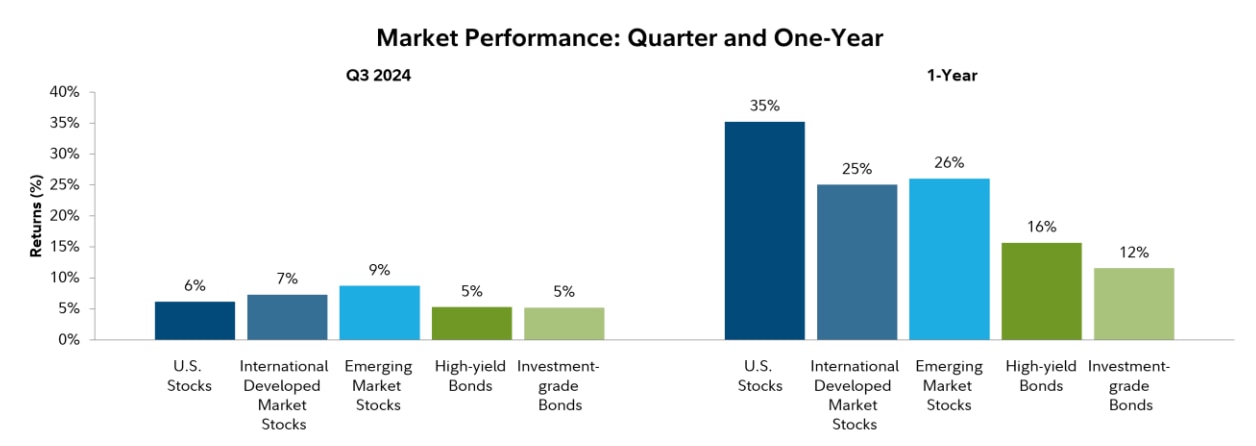

Strong quarter and year for both stocks and bonds.

- Utility and real estate stocks had the best quarter, supported by falling interest rates.

- Meanwhile energy and communication stocks faltered.17

Past performance is no guarantee of future results. Indexes are unmanaged. It is not possible to invest directly in an index. US stocks are represented by the Dow Jones US Total Stock Market Index, International Developed Market Stocks are represented by the MSCI EAFE Index (Net MA Tax), Emerging Market Stocks are represented by the MSCI Emerging Markets Index (Net MA Tax), High-yield Bonds are represented by the ICE BAML High Yield Constrained Index, and Investment-grade Bonds are represented by the Bloomberg U.S. Aggregate Bond Index. All data is as of 9/30/2024.

Outlook

Global expansion may support markets for the rest of the year.

- Economies have been growing across most countries around the world.

- Most companies in the U.S. and overseas expect earnings growth to continue.

- We assess the current economic conditions and believe that risk of recession remains low.

The outlook for corporate profits around the world remains positive and global economies largely appear healthy. Recent policy measures in China could have ripple effects that benefit China’s trading partners in the United State and across Europe and Asia. Furthermore, inflation rates around the globe have largely declined to more manageable levels.

Meanwhile, in the United States, further interest rate cuts will likely support additional economic growth. We are closely following the U.S. job market and many other measures to assess the health of the U.S. economy. The Fed‘s interest rate cuts appear focused on supporting the job market as inflation has fallen to more typical levels.

It’s important to note that as the U.S. presidential election gets closer, some news headlines may lead to periods of market volatility. Historically, stocks have experienced positive returns during presidential election years. If we can use history as our guide, corporate profit growth and economic expansion likely matter more for market performance than election outcomes. However, we will closely follow developments on the election and seek to manage risk within client accounts.

The foregoing commentary was prepared by Strategic Advisers LLC and Fidelity Management & Research Company LLC. Fidelity Personal and Workplace Advisers LLC (FPWA) has engaged Strategic Advisers LLC, its affiliate, to provide discretionary portfolio management services for Personalized Portfolios account: Total Return Investment Approach, subject to FPWA’s oversight.

Strategic Advisers LLC and Fidelity Management & Research Company LLC are a registered investment advisers and Fidelity Investments companies.

1Dow Jones U.S. Total Stock Market Index, as of 9/30/2024.

2MSCI All Country World (ACWI) ex U.S. Index (Net MA Tax) and Dow Jones U.S. Total Stock Market Index,respectively, as of 9/30/2024.

3 Personal Consumption Expenditures Price Index Excluding Food & Energy (core PCE price index), released 9/27/2024. The core PCE price index is the U.S. Federal Reserve’s (Fed) preferred measure of inflation and is closely watched by the Fed as it conducts monetary policy.

4Russell 1000 Value Index and Russell 1000 Growth Index, respectively, as of 9/30/2024.

5Russell 2000 Index and Russell 1000 Index, respectively, as of 9/30/2024.

6 U.S. Dollar Index, as of 9/30/2024.

7CSI 300 Index, as of 9/30/2024.

8 Based on a country-level breakdown of the MSCI Emerging Market Index, as of 9/30/2024.

9Bloomberg U.S. Aggregate Bond Index, as of 9/30/2024.

10Based on a sector breakdown of the Bloomberg Aggregate Bond Index, as of 9/30/2024.

11 ICE BofA US High Yield Constrained Index, as of 9/30/2024.

12Bloomberg US 3-Month Treasury Bellwether Index, as of 9/30/2024.

13Dow Jones U.S. Total Stock Market Index.

14 In our view, growth stocks have appeared expensive relative to value stocks. FactSet, based on forward price-to-earnings (PE) ratios for the Russell 1000 Growth Index and Russell 1000 Value Index, respectively, as of 9/30/2024. A PE ratio compares the price of a company’s stock to its earnings. It is commonly used to measure a company’s value.

15 Quality stocks tend to have stable earnings and low levels of debt relative to other stocks. These investments have historically done well in this phase of the business cycle.

16MSCI Emerging Markets Index.

17 Based on the GICS sector breakdown for the Dow Jones U.S. Total Stock Market Index, as of 9/30/2024.

* The Chartered Financial Analyst (CFA) designation is offered by the CFA Institute. To obtain the CFA charter, candidates must pass three exams demonstrating their competence, integrity, and extensive knowledge in accounting, ethical and professional standards, economics, portfolio management, and security analysis, and must also have at least 4,000 hours of qualifying work experience completed in a minimum of 36 months, among other requirements. CFA is a trademark owned by CFA Institute.

Keep in mind that investing involves risk. The value of your investment will fluctuate over time and you may gain or lose money.

Past performance is no guarantee of future results.

Diversification and asset allocation do not ensure a profit or guarantee against loss.

Indexes are unmanaged. It is not possible to invest directly in an index.

Stock markets are volatile and can fluctuate significantly in response to company, industry, political, regulatory, market, or economic developments. Investing in stock involves risks, including the loss of principal.

Foreign investments involve greater risks than U.S. investments, including political and economic risks and the risk of currency fluctuations, all of which may be magnified in emerging markets.

Lower-quality debt securities generally offer higher yields, but they also involve greater risk of default or price changes due to potential changes in the credit quality of the issuer.

In general, the bond market is volatile, and fixed-income securities carry interest rate risk. (As interest rates rise, bond prices usually fall, and vice versa. This effect is usually more pronounced for longer-term securities.) Fixed-income securities also carry inflation risk, liquidity risk, call risk, and credit and default risks for both issuers and counterparties. Unlike individual bonds, most bond funds do not have a maturity date, so holding them until maturity to avoid losses caused by price volatility is not possible.

Investments in smaller companies may involve greater risk than those in larger, more well‐known companies.

Index information:

Securities indexes are unmanaged and are not subject to fees and expenses typically associated with managed accounts or investment funds.

Benchmark returns assume the reinvestment of dividends and interest income. Investments cannot be made directly in a broad‐based securities index.

- The Bloomberg US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, governmentrelated and corporate securities, mortgage-back securities (agency fixed-rate pass-throughs), asset-backed securities and collateralized mortgage-backed securities (agency and non-agency).

- Bloomberg US 3 Month Treasury Bellwether Index is a market value-weighted index of investment-grade fixed-rate public obligations of the US Treasury with maturities of 3 months, excluding zero coupon strips.

- The Shanghai Shenzhen CSI 300 Index is a capitalization-weighted stock market index designed to replicate the performance of the top 300 stocks traded on the Shanghai Stock Exchange and the Shenzhen Stock Exchange.

- Dow Jones US Total Stock Market Index is a float-adjusted market capitalization–weighted index of all equity securities of US headquartered companies with readily available price data.

- ICE BofA US High Yield Constrained Index is a modified market capitalization–weighted index of US dollar denominated below investment grade corporate debt publicly issued in the US domestic market. Qualifying securities must have a below investment grade rating (based on an average of Moody’s, S&P and Fitch). The country of risk of qualifying issuers must be an FX-G10 member, a Western European nation, or a territory of the US or a Western European nation. The FX-G10 includes all Euro members, the US, Japan, the UK, Canada, Australia, New Zealand, Switzerland, Norway and Sweden. In addition, qualifying securities must have at least one year remaining to final maturity, a fixed coupon schedule and at least $100 million in outstanding face value. Defaulted securities are excluded. The index contains all securities of The ICE BofA US High Yield Index but caps issuer exposure at 2%.

- MSCI ACWI (All Country World Index) ex USA Index is a market capitalization-weighted index that is designed to measure the investable equity market performance for global investors of large and mid cap stocks in developed and emerging markets, excluding the United States. Index returns are adjusted for tax withholding rates applicable to U.S. based mutual funds organized as Massachusetts business trusts (NR).

- MSCI EAFE Index is a market capitalization-weighted index that is designed to measure the investable equity market performance for global investors of developed markets, excluding the U.S; Canada. Index returns are adjusted for tax withholding rates applicable to U.S. based mutual funds organized as Massachusetts business trusts (NR).

- MSCI Emerging Markets Index is a market capitalization-weighted index that is designed to measure the investable equity market performance for global investors in emerging markets. Index returns are adjusted for tax withholding rates applicable to U.S. based mutual funds organized as Massachusetts business trusts (NR).

- Russell 1000 Growth Index is a market capitalization–weighted index designed to measure the performance of the large-cap growth segment of the US equity market. It includes those Russell 1000 Index companies with higher price-to-book ratios and higher forecasted growth rates.

- Russell 1000 Index is a market capitalization–weighted index designed to measure the performance of the largecap segment of the US equity market.

- Russell 1000 Value Index is a market capitalization–weighted index designed to measure the performance of the large-cap value segment of the US equity market. It includes those Russell 1000 Index companies with lower price-to-book ratios and lower expected growth rates.

- Russell 2000 Index is a market capitalization–weighted index designed to measure the performance of the smallcap segment of the US equity market. It includes approximately 2,000 of the smallest securities in the Russell 3000 Index.

- The U.S. Dollar Index (USDX) indicates the general international value of the USD. The USDX does this by averaging the exchange rates between the USD and major world currencies. The ICE US computes this by using the rates supplied by some 500 banks. Security Description: Notes DXY Currency DOLLAR INDEX SPOT The U.S. Dollar Index (USDX) indicates the general value of the USD. The USDX does this by averaging the exchange rates between the USD and major world currencies. The ICE US computes this by using the rates supplied by some 500 banks.

Fidelity® Wealth Services provides non-discretionary financial planning and discretionary investment management through one or more Personalized Portfolios accounts for a fee. Advisory services offered by Fidelity Personal and Workplace Advisors LLC (FPWA), a registered investment adviser. Discretionary portfolio management services provided by Strategic Advisers LLC (Strategic Advisers), a registered investment adviser. Brokerage services provided by Fidelity Brokerage Services LLC (FBS), and custodial and related services provided by National Financial Services LLC (NFS), each a member NYSE and SIPC. FPWA, Strategic Advisers, FBS, and NFS are Fidelity Investments companies.

Effective March 31, 2025, Fidelity Personal and Workplace Advisors LLC (FPWA) will merge into Strategic Advisers LLC (Strategic Advisers). Any services provided or benefits received by FPWA as described above will, as of March 31, 2025, be provided and/or received by Strategic Advisers. FPWA and Strategic Advisers are Fidelity Investments companies.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917 © 2024 FMR LLC. All rights reserved.

556487.95.0

How Fidelity Charitable can help

Since 1991, we have been a leader in charitable planning and giving solutions, helping donors like you support their favorite charities in smart ways.

Or call us at 800-262-6039