Charitable trends

Fidelity Charitable's 2017 Giving Report highlights how the changes emerging in philanthropy have influenced donor-advised fund donors. Fidelity Charitable donors demonstrate a growing interest in responsive philanthropy, giving in response to national and international issues. They also increasingly look for smarter, more impactful ways to give.

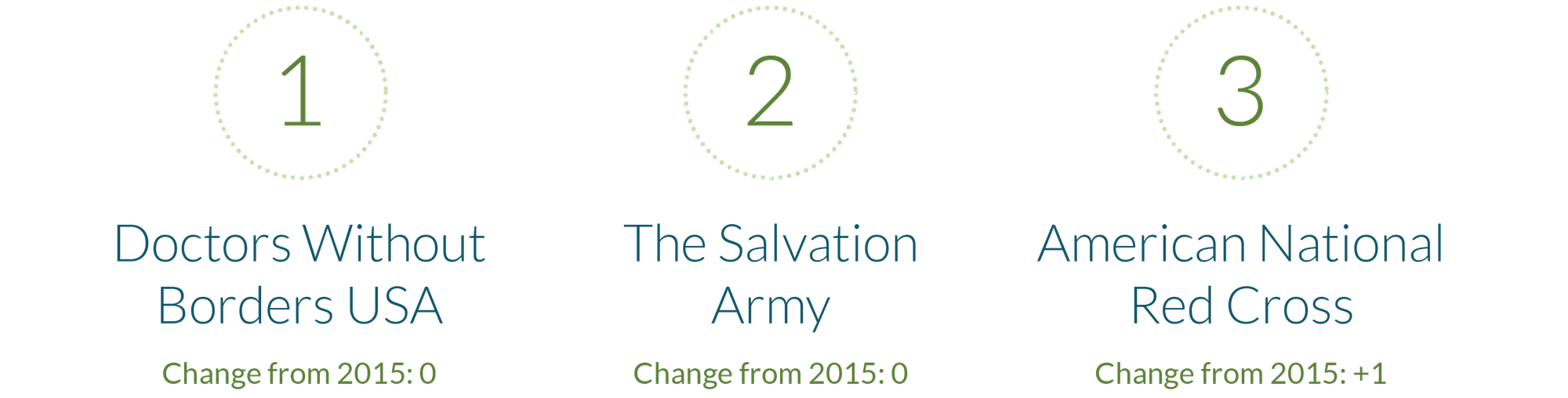

Fidelity Charitable’s top nonprofits list reflects donor response to national and international events.

Fidelity Charitable’s annual list of the most popular nonprofits—those that receive support from 1,000 or more Giving Accounts—expanded from 21 to 30 organizations in 2016, reflecting the increase in the number of Fidelity Charitable Giving Accounts and the steady overall increase in grants recommended by donors.

Many organizations on the top nonprofit list are mainstays, remaining at a relatively similar position year over year. This speaks to the broad reach these nonprofits enjoy, as well as the prominence of their causes across a wide canvas of donors nationally. However, changes on the 2016 list highlight how national and international events can mobilize certain segments of donors and drive temporary changes in the narrative of philanthropy. The ebb and flow of individual donors’ responses to issues drove some organizations to fall on the list, while other nonprofits made notable climbs, as demonstrated in the following analysis.

Ranking of the most popular charities at Fidelity Charitable in 2016

Several charities jumped in popularity, propelled by some donors’ responses to the 2016 election.

An increased number of Fidelity Charitable donors supported the American Civil Liberties Union Foundation, the Southern Poverty Law Center, Planned Parenthood and Natural Resources Defense Council at the end of 2016. This increase in new donor support aligns with national trends in giving following the 2016 general election. This support reflects how national or international events can activate groups of donors to give in new or different ways. For example, in the years after the 2008 election, conservative think tanks Heritage Foundation and American Enterprise Institute each broke fundraising records.1

After a surge of relief-related grants in 2015, donor support of UNICEF and Oxfam dipped last year.

While natural disaster relief needs remained significant in 2016, no crisis matched the level of donor interest in the 2015 Nepal earthquake. Subsequently, 12 percent fewer Giving Accounts supported Oxfam in 2016; UNICEF saw only a 3 percent decline in the number of Giving Accounts supporting it due to its response to Hurricane Matthew victims in Haiti.

International Rescue Committee moves onto the list as the Syrian humanitarian crisis continues.

Although some charities that provide crisis relief dropped in position on the list, the International Rescue Committee was a notable exception. The humanitarian aid nonprofit saw a 22 percent increase in Giving Account support, driven by the ongoing strife in Syria. Doctors Without Borders is also actively addressing the Syrian crisis, and it maintained a strong level of support last year. The Syrian refugee crisis moved into its sixth year in 2016; while it has received a consistent stream of support since it began, events such as the fall of Aleppo and cease-fire issuances served as catalysts for notable spikes in giving.

Donor activity also reflects the influence of newer giving strategies and trends.

Fidelity Charitable donors demonstrate some of the ways philanthropy is changing—from a heightened enthusiasm for impact investing to the growing use of non-cash assets to fund charitable giving.

Support for impact investing nonprofits is growing.

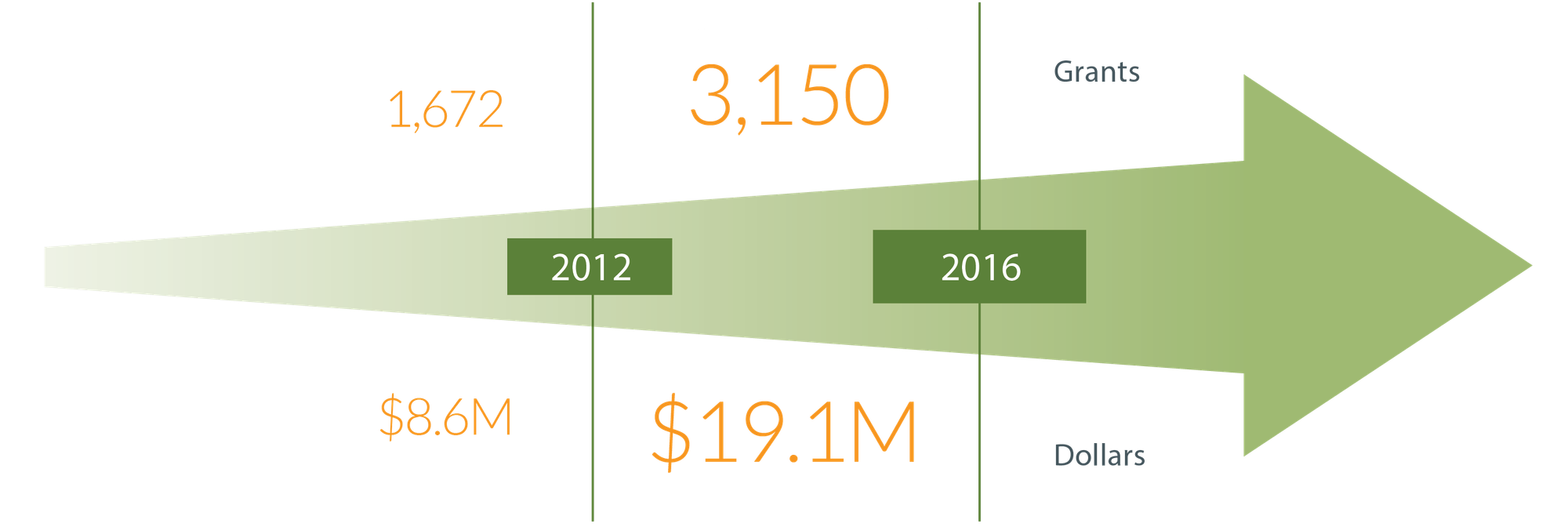

Last year, Fidelity Charitable made 3,150 donor-recommended grants to impact investing nonprofits, totaling $19.1 million. Impact investing is the idea that organizations or financial vehicles can help achieve social benefits while also generating financial returns. Support for impact investing nonprofits has grown over the last five years; in that time, Fidelity Charitable made $73 million in donor-recommended grants to impact investing nonprofits. Donors have also increasingly recommended investments into Fidelity Charitable’s impact investing pool. The increasing popularity of impact investing in recent years signals the strategy’s move from a relatively niche concept to a trend gaining in support among individual donors at all levels.

Grant volumes and dollars to impact investing nonprofits

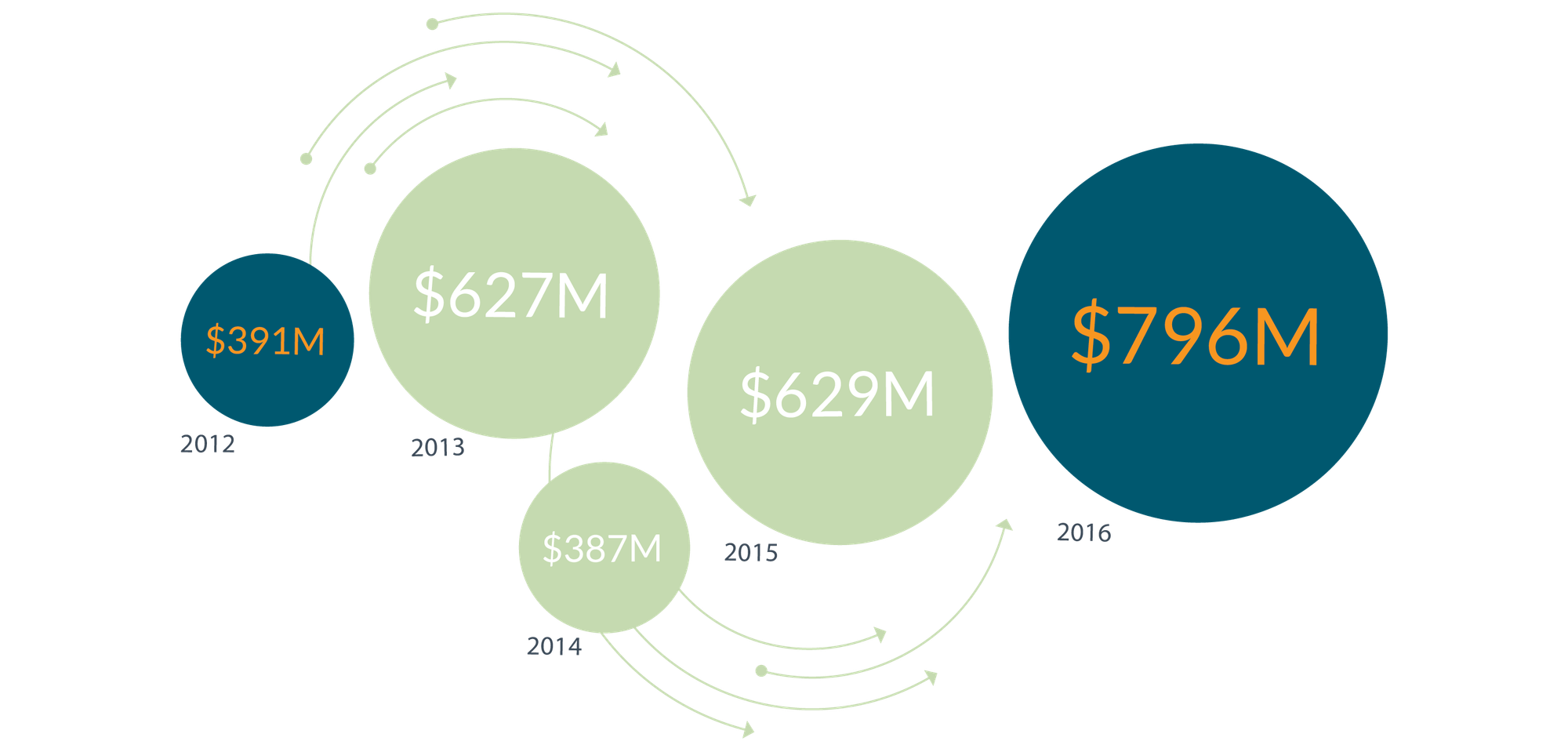

Donors increasingly fund their giving with a variety of non-publicly traded assets.

Non-publicly traded assets represent a significant portion of wealth in the United States but have traditionally been a largely untapped source of philanthropic funding.2 This is partly because these assets—including private stock, limited partnership interest and real estate—can be complicated both for individuals to give and for some nonprofits to accept.

Fidelity Charitable has expertise in donations of non-publicly traded assets and has seen notable growth in these types of contributions in recent years. Last year, Fidelity Charitable accepted a record $796 million in non-publicly traded assets, including nearly $125 million in restricted stock, which has become an increasingly popular type of asset to give. In 2016, Fidelity Charitable also accepted more than $7 million in Bitcoin.

Since inception, Fidelity Charitable has assisted in converting $3.1 billion of non-publicly traded assets into charitable dollars available for grants.

Non-publicly traded asset contributions in the last 5 years, by dollars

Want to learn more about changes in philanthropy? Visit The 2016 Future of Philanthropy to see how trends in giving are impacting donors.

1Inside Philanthropy, "Philanthropy Forecast, 2017," January 18, 2017.

2Deloitte Consulting, “The Next Decade in Global Wealth Among Millionaire Households,” 2011. The report states the top 1 percent of U.S. households hold 36 percent of their wealth in privately held businesses.

How Fidelity Charitable can help

Since 1991, we have been a leader in charitable planning and giving solutions, helping donors like you support their favorite charities in smart ways.

Or call us at 800-262-6039